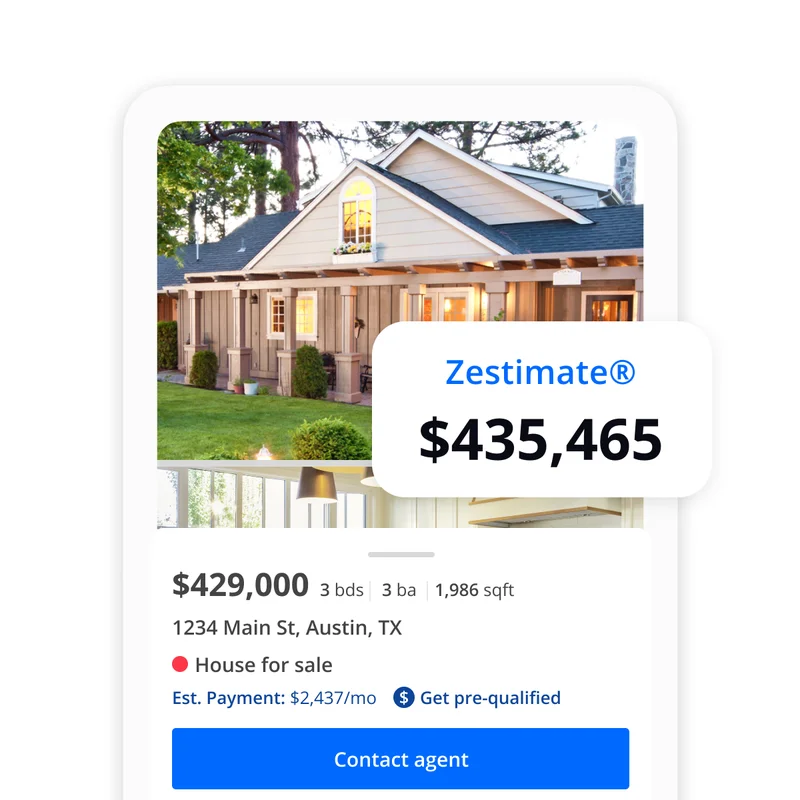

The Hidden Costs of Homeownership: A $16,000 Wake-Up Call?

Zillow’s latest analysis, conducted with Thumbtack, reveals that the hidden costs of owning a home in the U.S. have climbed to nearly $16,000 annually. That's $1,332 per month on top of your mortgage, which, let's be honest, is money a lot of people simply don't have right now. The real question is whether this figure is a genuine reflection of rising expenses, or a strategically amplified number designed to spook potential buyers.

The report highlights that these costs – primarily encompassing maintenance, property taxes, and homeowner's insurance – have surged from $9,080 in 2017 to $14,155 in 2023, before hitting the current $15,979. It's a steep climb, no doubt, and Zillow is framing this as a significant barrier to entry for prospective homeowners. They’re saying families are already “stretched thin,” and these costs only worsen the situation. It's a compelling narrative, but let's dig into the numbers.

The Maintenance Mirage

Maintenance accounts for the bulk of these hidden costs, averaging $10,946 annually. This is where my skepticism kicks in. How did they arrive at this figure? Did they factor in the DIY-inclined homeowner who handles basic repairs themselves, or are they solely relying on professional service estimates? Because if you're paying nearly $11,000 a year on maintenance, you're either living in a money pit or getting seriously ripped off. (The report doesn't specify the methodology, a glaring omission.)

Property taxes and homeowner's insurance contribute $3,030 and $2,003, respectively, to the total. These numbers are easier to verify, as they're based on publicly available data and insurance premiums. However, regional variations are significant. Coastal metro areas like New York City ($24,381) and San Francisco ($22,781) bear the brunt of these costs. But what about smaller cities, rural areas? Are those figures dragging down the national average?

Florida: The Insurance Inferno

Florida is, unsurprisingly, a major driver of rising insurance costs. Miami premiums have jumped 72% since 2020, now averaging $4,607 annually. Jacksonville, Tampa, and Orlando have seen similar spikes. This isn't just about hurricanes; it's about the long-term viability of homeownership in a state increasingly vulnerable to climate change. And this is the part of the report that I find genuinely concerning. If insurance companies are pulling out of Florida, or drastically raising rates, it's not just a "hidden cost"—it's an existential threat to the housing market.

Kara Ng, Zillow's senior economist, notes that insurance costs are rising nearly twice as fast as homeowner incomes. It's a valid point, but it's crucial to remember that averages can be misleading. What's the median income increase versus the median insurance cost increase? Are we looking at skewed data due to high earners skewing the average? This is a critical distinction. According to Zillow Reveals the Hidden Costs of Homeownership, these rising costs are making it more difficult for potential buyers to enter the market.

The report suggests buyers should "plan for maintenance costs early," opt for new-construction homes, and consider townhomes or condos. It's sound advice, but it also feels like a tacit admission that the single-family home dream is becoming increasingly unaffordable for many Americans.

Is Homeownership Still Worth It?

Zillow presents this data as a cautionary tale, urging buyers to understand their true buying power. But here's the thing: homeownership is more than just a financial equation. It's about stability, community, and building equity. While these hidden costs are undoubtedly a factor, they shouldn't overshadow the long-term benefits. The key is to do your homework, understand your local market, and budget realistically.

A Reality Check

Zillow's report serves as a stark reminder: owning a home isn't just about the mortgage. But before panicking, take a closer look at the numbers. Regional variations and individual circumstances play a huge role. Don't let the headlines scare you; do your own calculations.